YouGov released a survey showing that 36% of the polled participants anticipate a wide adoption of cryptocurrency in the future. However, 25% of the participants still think that Bitcoin mostly promotes illegal transactions. Meanwhile, the survey revealed that nearly 50% of millennials “are interested in using cryptocurrencies as a primary form of payment.”

The Revolution

Coin Dance wants to decentralize “the revolution” with its community-driven protocol that provides statistics and services for Bitcoin and Bitcoin Cash. An article from CoinCentral, Coin Dance | Community Driven Cryptocurrency Statistics, by Ryan Smith, explains how the mission of Coin Dance is to move towards an “open world, where transparency and co-operation will probably be the tools of the future.” The features offered by Coin Dance include:

- Volume Charting – shows the worldwide volume of peer-to-peer marketplaces

- Vanity Service – gives users a personalized Bitcoin address

- Poker – offers a single-table No-Limit Texas Hold’em cash game where anonymous users can play for real bitcoins

- Statistics – presents a range of Bitcoin statistics including price ranges, demographics, and market capitalizations

- Nodes – reports which Bitcoin nodes are running

- Politics & Opinion – keeps track of Bitcoin developments in governments

- Blocks – verifies the latest blocks mined and health of the network

- Resources – provides links to the best online Bitcoin resources

Coin Dance allows any member of the community to contribute to the platform’s growth decisions, regardless of a member’s social or economic status. As a result, the Coin Dance community controls the data that is provided by the platform.

Cryptocurrency Generation

Cryptocurrency Generation

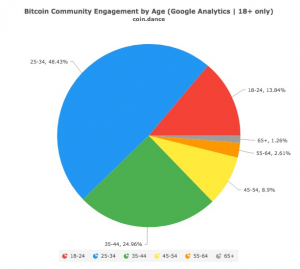

Millennials represent a large population segment in the United States. Currently, Millennials dominate cryptocurrency investing, according to the data gathered on Coin Dance. Further, millennials are more likely to invest in cryptocurrency. On the other hand, they are skeptical about investing in the stock market. Edelman, a communications and marketing firm, reported that 25% of wealthy millennials own or are using cryptocurrency. In addition, another 31% are considering using cryptocurrency in the future.

Millennials also have an interest in peer-to-peer (P2P) lending and other cryptocurrency financial tools. MintDice explained that the rapid development of P2P cryptocurrency lending allows lenders to connect with borrowers. In a case study by MarketWatch, a millennial engineer expressed enthusiasm that cryptocurrencies “have the potential to replace bank lending, financial litigation and a lot of things that make life incredibly complicated for ordinary people.”